As higher interest rates throw cold water on what’s been a boiling U.S. housing market over the last two years, there’s a deeper problem that’s keeping prices high.

And it’s a problem that’s been around a lot longer — before the COVID-19 pandemic and its low interest rates set off a housing frenzy.

It’s a lack of supply. In other words? A national housing shortage.

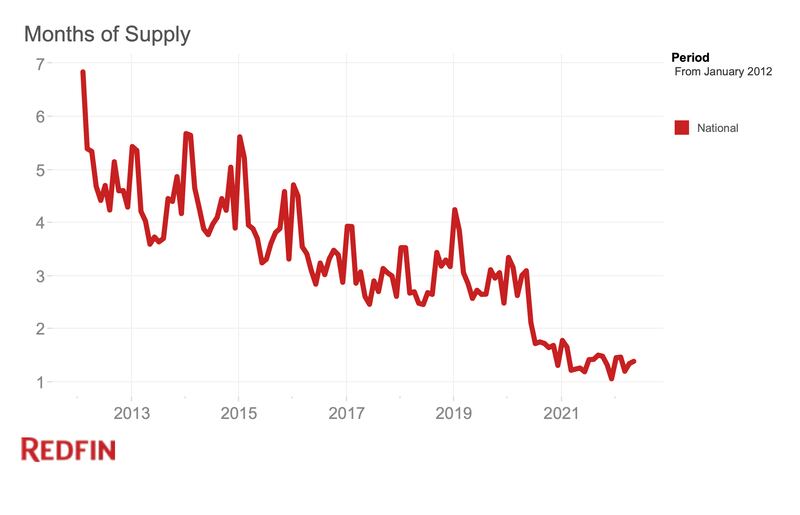

The supply of homes is at a historic low in the U.S., according to data by Redfin, a national real estate brokerage. Data available at Redfin’s Data Center shows the nation’s months of supply of homes has dropped to new low in at least the last 10 years.

The months of supply metric shows how many months it would take for all the current homes for sale on the market to sell, given a monthly sales volume.

“Four to five months of supply is average,” according to Redfin’s definition of the metric. “A lower number means that buyers are dominating the market and there are relatively few sellers; a higher number means there are more sellers than buyers.”

Typically, when months’ supply of homes is low, so are the number of days a home spends on the market before it’s snatched up. And when months’ supply is tight, that naturally keeps pressure on prices due to classic supply versus demand. The lower number of homes for sale means more buyers will be willing to pay above asking price to get their foot in the door.

America’s housing shortage is not new news. It’s been a lingering problem for years now — especially after the entire market contracted after the 2006 housing bubble popped and homebuilding constricted amid the Great Recession.

In September of last year, a Realtor.com report estimated the U.S. was short 5.24 million homes — an increase of 1.4 million homes from 2019. The pandemic only “exacerbated” that housing shortage, said Danielle Hale, a chief economist for realtor.com

Where is housing supply the tightest?

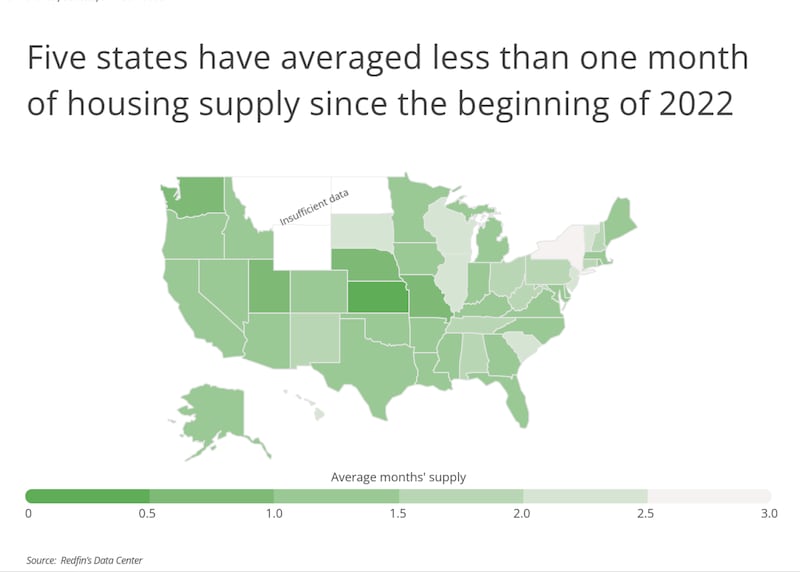

While the U.S. at large has been grappling with a housing shortage, certain markets have it worse than others.

For those of us that live in Utah — which has been one of the nation’s fastest-growing states — signs of a housing shortage are obvious, especially over the last two years. High prices. Tight inventory. Brutal competition. Homes flying off the market in just a matter of days.

Sure enough, Utah is one of five states — along with Kansas, Washington, Nebraska and Missouri — that have averaged less than one month of housing supply since the beginning of 2022, according to an Inspection Support Network analysis of Redfin data.

The data for Inspection Support Network’s analysis is from January 2022 through May 2022, from Redfin. To pinpoint the areas with the least home inventory, Inspection Support Network researchers calculated the average months’ supply over that time period.

alt=Katie McKellar

alt=Katie McKellar